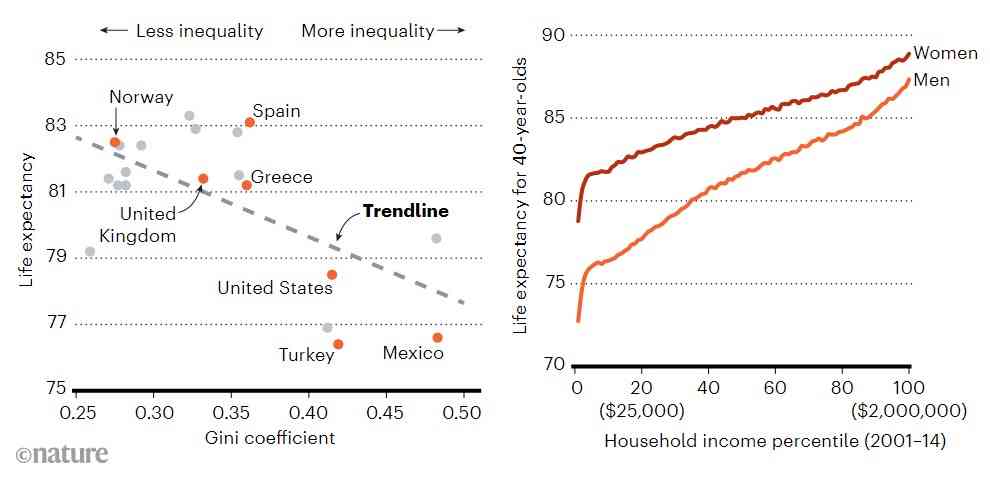

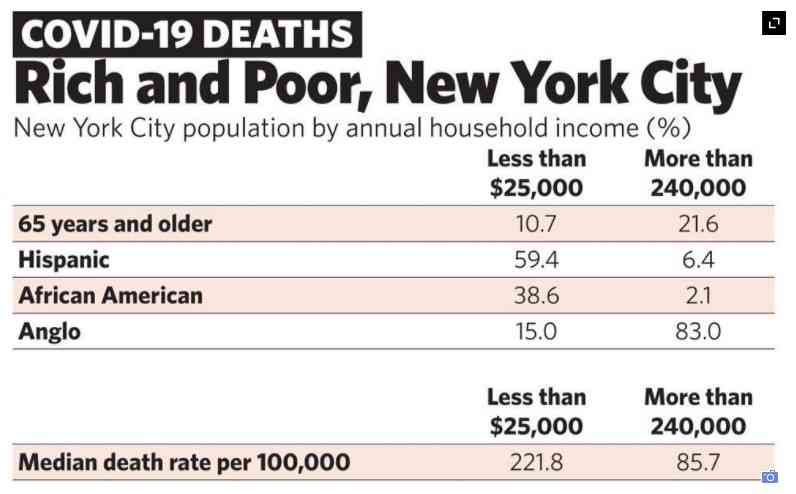

A long reported piece in Nature examines why the poorest people are the most vulnerable to disease, and how our inadequate systems of regulation and support make matters worse. A Covid story with implications that extend far into the future.

https://www.nature.com/immersive/d41586-021-00943-x/index.html